Catastrophe Adjuster Assistance for Making Best Use Of Insurance Claim Recovery

Catastrophe Adjuster Assistance for Making Best Use Of Insurance Claim Recovery

Blog Article

Navigating Insurance Claims: Why You Need a Skilled Catastrophe Adjuster in your corner

In the consequences of a catastrophe, navigating the ins and outs of insurance coverage claims can become an overwhelming job, usually exacerbated by the psychological toll of the occasion itself. An experienced catastrophe adjuster is not merely an advocate yet a vital partner in making sure that your insurance claims are evaluated precisely and fairly.

Comprehending Catastrophe Adjusters

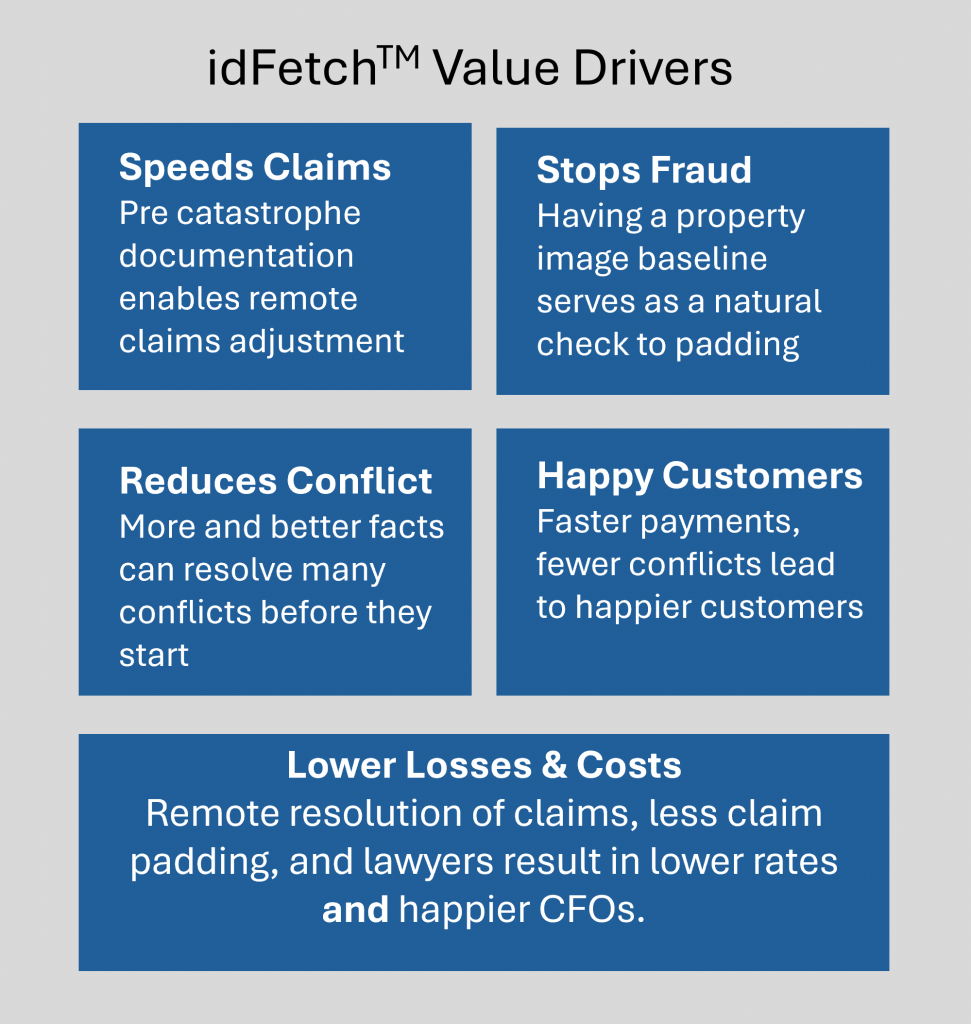

Disaster insurance adjusters play an important function in the insurance policy industry, specifically in the after-effects of considerable disasters. These specialists concentrate on taking care of claims associated with large-scale occasions such as earthquakes, hurricanes, and wildfires, which typically result in extensive damages. Their experience is essential for effectively examining losses and ensuring that insurance policy holders obtain fair compensation for their insurance claims.

The primary duty of a catastrophe insurer is to review the degree of damage to homes, vehicles, and various other insured possessions. This entails performing detailed evaluations, collecting documentation, and working together with different stakeholders, consisting of insurance policy holders, specialists, and insurer. In most cases, catastrophe insurers are deployed to impacted areas soon after a catastrophe strikes, enabling them to give prompt support and accelerate the claims procedure.

In addition, catastrophe insurance adjusters should have a deep understanding of insurance plan and policies to properly translate insurance coverage terms. Their analytical skills and focus to detail are critical in identifying the authenticity of claims and recognizing any kind of possible fraudulence. By browsing the intricacies of disaster-related insurance claims, disaster insurers play an indispensable duty in restoring the economic security of afflicted individuals and neighborhoods.

The Claims Refine Clarified

When a disaster strikes, recognizing the cases procedure is vital for policyholders seeking payment for their losses. This process commonly starts with alerting your insurance provider concerning the incident, supplying them with details such as the day, time, and nature of the damage. Following this preliminary record, an insurer will be designated to assess your claim, which includes examining the loss and identifying the level of the damage.

Paperwork is a vital part of the claims process. Policyholders need to collect proof, consisting of photographs, receipts, and any type of various other essential details that supports their case. When the insurer has conducted their analysis, they will submit a record to the insurer. This report will detail their findings and offer a recommendation for settlement based upon the policyholder's insurance coverage.

After the insurance firm evaluates the insurer's report, they will certainly make a choice pertaining to the case. Recognizing these steps can dramatically help in browsing the complexities of the cases procedure.

Benefits of Hiring an Insurance Adjuster

Employing an insurance adjuster can offer many benefits for insurance policy holders browsing the cases process after a calamity. Among the key advantages is the knowledge that a skilled catastrophe adjuster brings to the table. They have extensive understanding of insurance plan and case procedures, allowing them to precisely examine damages and supporter effectively for the insurance holder's passions.

Furthermore, an adjuster can relieve the tension and intricacy related to submitting an insurance claim. They handle interactions with the insurance provider, ensuring that all required documents is sent without useful reference delay and properly. This degree of organization aids to accelerate the cases process, minimizing the moment policyholders should wait on settlement.

Furthermore, insurers are proficient at negotiating settlements. Their experience permits them to identify all prospective problems and losses, which might not be quickly evident to the policyholder. This thorough assessment can bring about a more positive settlement quantity, making sure that the policyholder receives a reasonable analysis of their claim.

Choosing the Right Insurer

Picking the ideal adjuster is important for making sure a smooth claims process after a calamity. When faced with the aftermath of a devastating occasion, it is necessary to choose an insurance adjuster who has the right credentials, experience, and neighborhood knowledge. An experienced catastrophe insurance adjuster must have a strong performance history of handling comparable claims and be skilled in the intricacies of your certain insurance coverage.

When you have a shortlist, conduct meetings to assess their communication abilities, responsiveness, and desire to promote for your interests. A skilled insurance adjuster should be transparent concerning the cases process and supply a clear outline of their fees. Count on your instincts-- select an adjuster with whom you really feel positive and comfortable, as this collaboration can dramatically affect the outcome of your case.

Typical Myths Debunked

Misconceptions concerning disaster adjusters can lead to confusion and hinder the insurance claims process. One common myth is that catastrophe insurance adjusters work exclusively for insurer. Actually, lots of adjusters are independent experts who promote for insurance policy holders, ensuring reasonable assessments and page settlements.

One more misunderstanding is that working with a catastrophe insurance adjuster is an unneeded expense. While it is true that insurers bill costs, their expertise can often result in higher insurance claim settlements that far outweigh their expenses, ultimately benefiting anonymous the insurance policy holder.

Some individuals believe that all insurance claims will be paid completely, despite the circumstance. However, insurance coverage commonly include details terms and conditions that might restrict insurance coverage. Comprehending these nuances is essential, and a competent insurer can help navigate this intricacy.

Final Thought

In summary, the participation of a competent disaster insurance adjuster considerably enhances the cases procedure complying with a disaster. Their proficiency in damages assessment, plan interpretation, and negotiation with insurance providers makes certain that people get equitable payment for losses sustained. By easing the complexities related to cases, these professionals not only expedite the process but additionally provide vital support during challenging times. Eventually, the choice to engage a disaster insurance adjuster can have an extensive effect on the outcome of insurance policy claims.

In numerous cases, disaster insurance adjusters are deployed to affected areas shortly after a disaster strikes, allowing them to give prompt assistance and quicken the insurance claims procedure. - catastrophe adjuster

A knowledgeable catastrophe adjuster must have a solid track document of taking care of comparable insurance claims and be fluent in the details of your particular insurance plan.

Begin by researching potential insurers, looking for expert classifications such as Licensed Insurance Adjuster or Accredited Claims Adjuster. catastrophe adjuster.Misunderstandings concerning disaster adjusters can lead to confusion and prevent the insurance claims process.In summary, the participation of an experienced catastrophe insurer significantly boosts the cases process complying with a calamity

Report this page